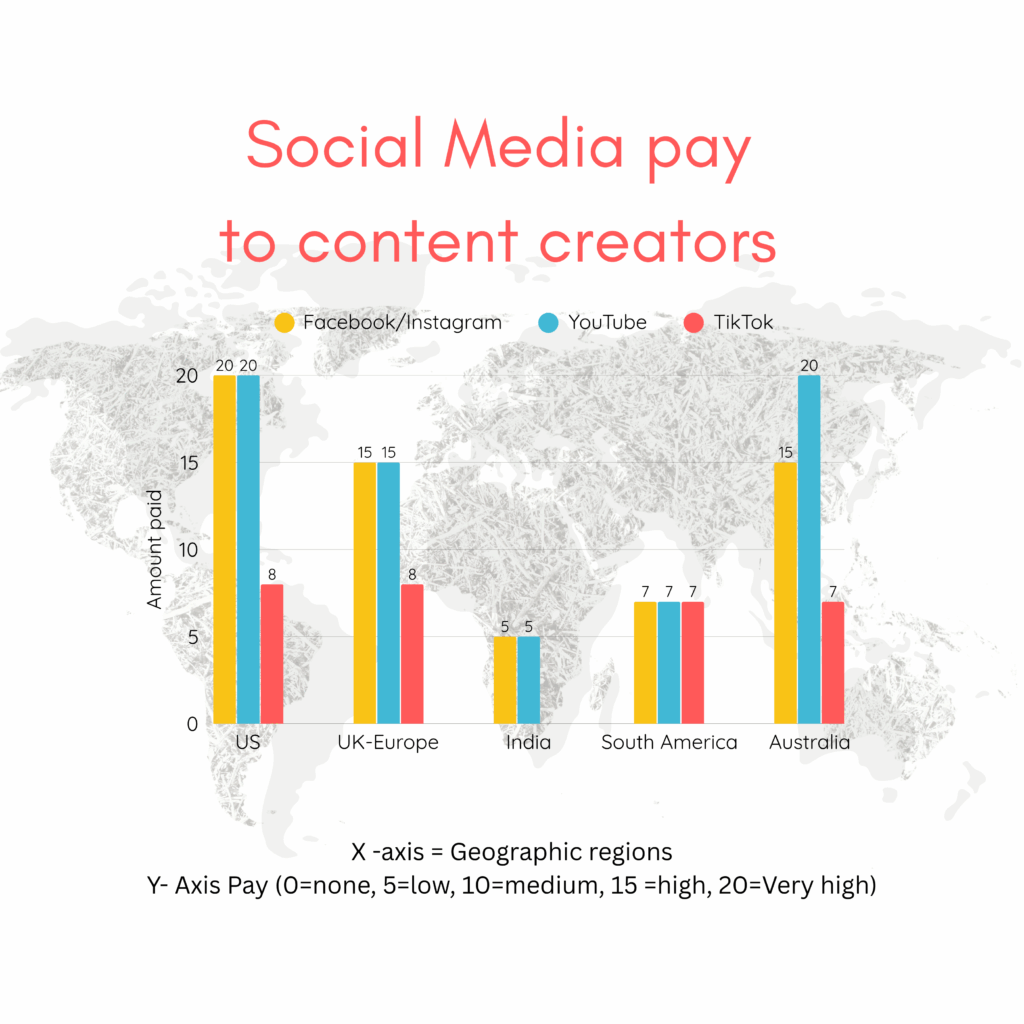

Advertising rates – and therefore creator payouts – don’t just depend on the platform; they depend heavily on where your viewers live. Brands pay more to reach audiences in wealthy, competitive markets (like the US, UK, and Australia) and much less in emerging markets (like India and much of South America).

Industry data for 2025 shows:

- YouTube CPM (ad cost per 1,000 views) is highest in countries like Australia and the US, with Australia often ranking at or near #1 globally.

- India and Brazil have far lower CPMs on average, even though they provide massive view volumes.

- On Facebook, the US and Australia sit in the high-CPM tier (over $10+ CPM in many verticals), while countries like India and Brazil often see CPMs in the low single digits.

Because platforms usually share ad revenue (e.g., YouTube and Facebook) or pay from fixed creator pools (TikTok, some Instagram bonuses), these CPM gaps translate directly into different earnings per 1,000 views for creators.

Approximate Relative Earnings per 1,000 Views by Region

Instead of pretending there’s one “exact” global number, it’s more honest (and useful) to show relative earning power across regions and platforms.

Legend:

🔥 Very High – among the best places to earn per 1,000 views

⬆ High – strong earning power

⬅ Medium – decent but not top-tier

⬇ Low – relatively weak payouts

⛔ N/A – platform not available / no meaningful direct payouts

| Region/Platform | YouTube(Long-Form) | Facebook(Videos/Reels with Ads) | Instagram(Reels/Bonuses,direct) | TikTok(Creator Fund/Rewards) |

| US | 🔥 Very High | 🔥 Very High | ⬆ High (where bonuses/sponsorships apply) | ⬇ Low–Medium (new Rewards program slightly better) |

| UK | ⬆ High | ⬆ High | ⬆ High (strong brand deals, limited bonuses) | ⬇ Low–Medium (similar to US where program is live) |

| Australia | 🔥 Very High (often top CPM globally) | ⬆ High (CPM ~US tier but slightly lower) | ⬆ High (good brand spend, some bonus access) | ⬇ Low–Medium (where Rewards is available) |

| India | ⬇ Low (needs huge scale; CPM often well under $1) | ⬇ Low (one of the cheapest Facebook markets) | ⬇ Low direct payouts, but improving (₹20–₹50 / 1,000 Reels views typical) | ⛔ N/A (TikTok banned) |

| South America(Brazil) | ⬅ Medium–Low (CPM higher than India but far below US/AU) | ⬅ Medium–Low (Facebook CPM ~2–4 USD typical) | ⬇ Low–Medium direct payouts; brand deals vary by niche | ⬇ Low–Medium (Creator payouts low, but audience size huge) |

This doesn’t mean you “can’t make money” in lower-CPM regions. It means:

- A creator in Australia or the US may earn several times more per 1,000 views than someone in India or Brazil on the same platform and in a similar niche.

- Creators in India and Brazil often compensate with huge volume (millions of views) and strong brand deals aimed at local markets.

Platform-by-Platform View with Australia & South America Highlighted

YouTube

- Australia & US: Among the best places in the world for YouTube ad revenue. CPM data consistently ranks Australia at or near the top, with the US very close behind. Creators targeting these audiences can see extremely strong RPM (revenue per 1,000 views) if their niche is advertiser-friendly.

- UK: Slightly lower than US/Australia but still in the high tier.

- Brazil (South America): CPM is higher than India but significantly below US/UK/Australia, so per-view earnings are medium–low unless you’re in a high-paying niche.

- India: CPM is at the very low end globally – meaning you need a big audience and/or strong sponsors to earn serious money from ads alone.

- US, UK, Australia: Facebook CPMs here are often 10–20+ USD for many campaigns, placing them in the high earning category. Creator revenue share on in-stream ads and Reels ads reflects that – you typically earn more per 1,000 views compared to lower-CPM regions.

- Brazil & broader South America: CPMs are lower – generally a few dollars or less – but the region has huge Facebook penetration and engagement, which can compensate in volume.

- India: One of the cheapest markets for Facebook ads; great for advertisers, tough for creators relying purely on ad share.

Instagram doesn’t have a consistent, global “pay-per-view” like YouTube. Direct payouts (Reels bonuses, ads on Reels/IGTV) have:

- US, UK, Australia: Access to more bonus programs historically and stronger brand budgets, so effective earnings per 1,000 views (including sponsorships) can be high, even if the platform’s own bonus rates are modest (often cents to a few dollars per 1,000 views).

- India & Brazil: Direct payouts are usually cents per 1,000 views (₹20–₹50 / 1,000 Reels views typical in India), so creators here lean heavily on brand deals, affiliate marketing, and selling products.

TikTok

- TikTok’s legacy Creator Fund paid roughly $0.02–$0.04 per 1,000 views, no matter the country – painfully low even in top markets.

- The newer Creator Rewards / Creativity Program improved payouts (roughly $0.20–$1.00 per 1,000 views in eligible countries), but that still trails most YouTube and Facebook long-form payouts in US/UK/Australia.

- US, UK, Australia, Brazil: Relative earnings are low–medium, and most serious TikTok creators treat it as a top-of-funnel audience engine that feeds people to Instagram and YouTube where monetization is stronger.

- India: TikTok is banned, so there is effectively no direct TikTok payout for Indian creators; they typically focus on Reels and YouTube Shorts instead.